Is an ESOP a Good Fit?

An employee stock ownership plan (ESOP) is a great way to sell a business that not only benefits the selling shareholders, but delivers an amazing boost to the company and the employees who form it. Moreover, owners are able to sell as much of their business to their employees as they would like, with the ability to stay on and run things as usual. With close to 7,000 US companies using ESOPs (which employ 14 million people), ESOPs are quickly becoming a more popular exit strategy for owners looking to maximize benefits, minimize tax implications, preserve their legacy, and reward their employees.

-

Are you thinking about an exit/succession plan for your company?

-

Do you want to preserve your legacy and have the ability to manage the company after the transaction?

-

Do you want to keep your business local, retaining jobs and having wages & profits invested back into the community?

-

Could you and your company benefit from huge tax incentives?

-

Do you want to provide a great retirement plan for your employees that helped make your company what it is today?

-

Are you looking to receive immediate cash flow & future opportunity via warrants?

ESOPs Explained

Much like a 401k-qualified retirement plan, an ESOP is a tax-qualified retirement plan under the Employee Retirement Income Security Act (ERISA) that provides a company’s workforce with ownership interest in the company at no cost. However, unlike all other retirement plans, ESOPs can be leveraged by borrowing money to purchase stock in the company. Moreover, ESOPs provide the seller with a ready & able buyer, fair market value for their company, and the ability to maintain control through the entire ESOP transition period and beyond. Seller's can find comfort knowing they have control over their legacy and that their employees will be left better off in many ways. ESOPs allow employees to accumulate shares of company stock into their retirement accounts that they can then sell when they retire or leave, and this stock will never cost the employees a single penny.

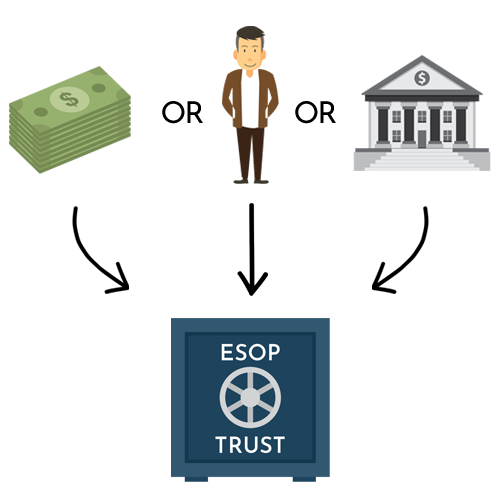

Setting up the Trust

An ESOP trust is set up through which Steve sells shares of his company to the employees. The trust holds the shares on behalf of the employees.

Contributions to the Trust

The company can now fund the trust by using its own cash or borrowing money from a bank or the seller, Steve. If the ESOP borrows money, the company makes tax-deductible contributions to the trust to enable it to repay the loan.

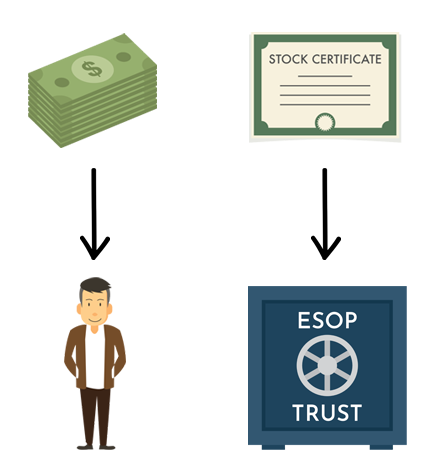

Purchasing Company Stock

Using the money from company contributions, the trust buys a percentage of the company's stock from Steve (% depends on how plan is set up) to be held in the trust. Steve will receive fair market value, determined by an independent appraiser, for his shares of stock.

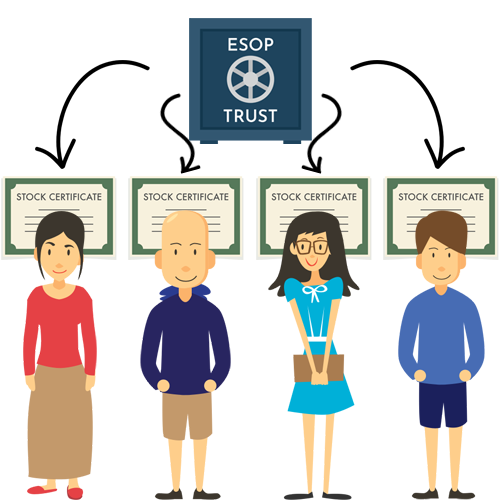

Allocation of Shares

Once the shares have been purchased, the shares in the trust are allocated to individual employee accounts. If the company borrowed money, the shares will be allocated as it pays off the loan. Employees receive the shares based on relative pay.

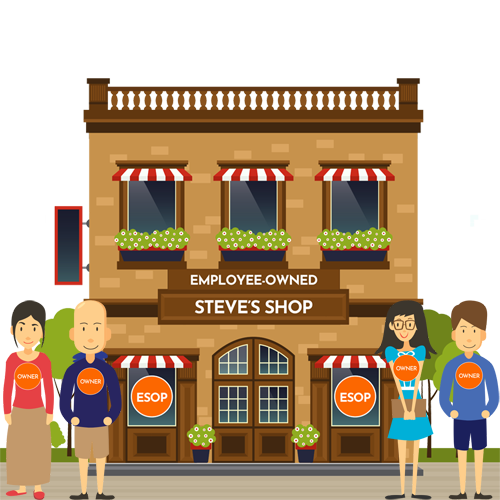

Employee-Owned

The employees become owners of Steve's Shop over time with every purchase of the company. The percentage a company is employee-owned is determined within the plan during the transaction based on what Steve wants and what would be most beneficial. The employees experience greater job stability and share in the rewards of company profits. Moreover, the community enjoys job and local business retention.

Sold But Staying On

Not only has Steve sold his company the way he wanted, but he sold it to the people that he cares about and that have made his company great. Moreover, Steve also has the option to stay on with the company managing things to make sure the transition goes smoothly and ease out of the company as he sees fit. Steve benefits, the company benefits, the employees benefit, the community benefits, and Steve's legacy is preserved.

ESOP Numbers

-

2%

A 2000 Rutgers study found that ESOPs boost sales & employment by more than 2% year over year compared to their non-ESOP counterparts.

-

4% - 5%

Other studies have found productivity increases of up to 4% – 5%, on average, in the year an ESOP is adopted

-

2.2x & 20%

The same study found that ESOP participants have 2.2 times as much in retirement plans & 20% more financial assets overall than employees of the comparison group of non-ESOP companies.

-

5% - 12%

A study found employee-owners earning 5% - 12% more in median wages compared to employees in matching non-ESOP companies. Moreover, employee-owners typically enjoy better benefits, including job training.

-

92%, 33%, 53%

A new survey compared people age 28 - 34 with employee ownership to their peers without. The study found that those with employee ownership enjoyed 92% higher median household wealth, 33% higher income from wages, and 53% longer median job tenure.

-

9.5% > 1.3%

Nationally representative surveys consistently show employee-owners less likely to report being laid off in the previous year. In 2014, the layoff figure was 9.5% for all working adults compared to 1.3% for employee-owners.